Securing Supply Chains for the Low-Carbon Economy: The Case of Electric Batteries

A view of the underfloor panel with the battery cell of an electric car at the Mercedes-Benz plant in Sebaldsbrueck, Bremen. (DAVID HECKER/EPA-EFE/Shutterstock)

The transition to low-carbon technologies is creating new dependencies for the European economy. Especially critical for Germany: electric batteries. To reduce risks and reshape emerging global value chains, Berlin and other EU governments must prioritize a comprehensive governance approach.

Russia’s war against Ukraine and the resulting energy crisis of 2022 have painfully demonstrated how authoritarian regimes can use the EU’s economic ties as an instrument of political coercion. By creating scarcity in the market, driving up energy prices and spreading economic insecurity, state-linked Russian energy firms have put massive economic pressure on several EU member states.

The prospect of such “informal” sanctions being imposed on the EU by other actors is, however, not limited to gas and oil supplies. As the bloc shifts away from the fossil-fuel economy, new geopolitical risks are emerging related to the globalized supply of low-carbon technology. Already, the organizational and geographical complexity of these new value-chain arrangements is creating bottlenecks that may enable outside political interference in the EU economy.

Key Points:

- Germany and the EU must organize government support for domestic and European tech and mining companies to build more resilient value chains in the battery sector.

- To level the playing field, EU governments need to do more to support the investment and sourcing strategies of the European private sector, including through bilateral partnerships and governance arrangements.

- To reduce international dependencies, EU members should develop a common strategy for the control of the emerging supply networks for batteries and related raw materials.

- EU member-state governments and EU institutions should jointly drive new and more ambitious European industrial projects in the battery sector.

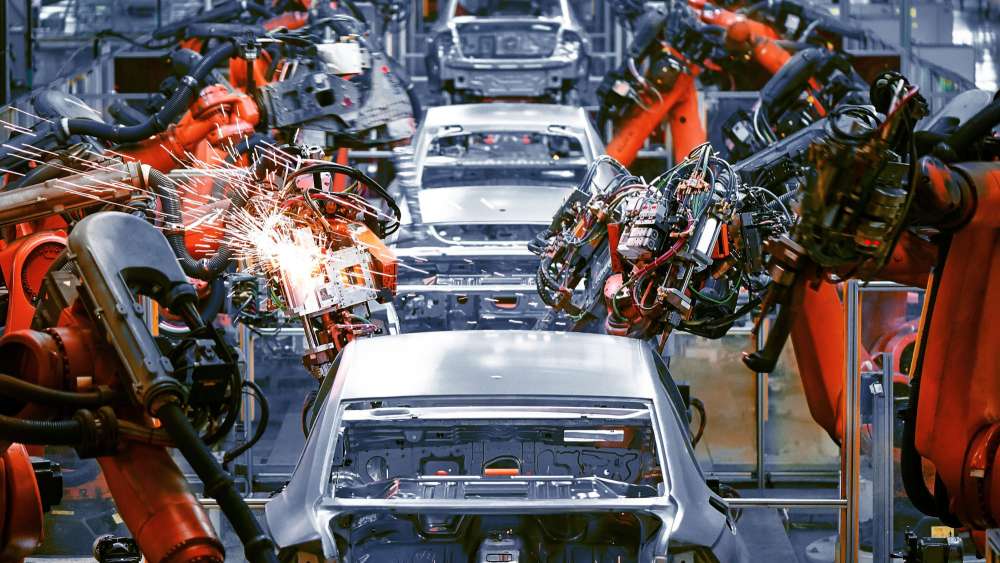

A case in point is modern battery technology. Electric batteries are crucial for the production of various commercial and strategic technologies – like consumer electronics, energy storage systems or military equipment. From the German perspective, their increasing use in the automotive industry is especially critical: as the main national carmakers are refocusing their product strategies on electric vehicles, prolonged disruptions of the global battery supply could shut down entire automotive factories in Germany and abroad.

Within the existing value-chain arrangements of the battery sector, the EU economy is highly dependent on the supply of critical raw materials, processing capacities and technological components from a small number of countries. In the upstream segment of the value chain, which encapsulates the extraction of natural resources, Chile currently provides over 70 percent of the EU’s lithium supply, while the Democratic Republic of Congo delivers over 60 percent of the cobalt processed in the EU. China, for its part, meets around half of the Union’s overall demand for natural graphite. Moreover, the EU’s international dependence in the low-carbon sector also results from the fact that its own manufacturing capacity for battery cells is still relatively weak. In 2020, the EU’s production accounted for only 9 percent of the global battery output.

Growing Concerns Over China’s Dominance

From a geopolitical standpoint, the key concern of EU policymakers has been China’s dominant position in the battery value chain, including when it comes to related raw materials. Given the current political tensions around Taiwan (and Ukraine), Europe’s structural dependency on Chinese-controlled suppliers may easily become a major liability for the entire EU economy. As things stand, China is by far the largest producer of battery cells in the world – providing almost three-quarters of the total global production. In addition, the country controls a significant part of the world’s refining capacity for critical minerals such as lithium, cobalt and nickel.

Considering recent trade disputes involving China, EU policymakers are justified in their concerns. Chinese authorities already have a record of using international value-chain dependencies as leverage to exert political pressure. In 2010, amid a territorial row with Japan, China drastically restricted its exports of the so-called rare-earth elements, on which Beijing had a near-monopoly at the time. Due to the embargo, prices in the global minerals markets skyrocketed, causing disruptions in the production of various high- and clean-tech goods in other countries.

» Chinese authorities already have a record of using international value-chain dependencies as leverage to exert political pressure. «

In response to the growing geopolitical risks associated with the emerging value chains for a low-carbon economy, Germany and the EU have recently launched several policy initiatives that are aimed at reducing the region’s vulnerabilities in the battery and raw materials sectors. In 2010 and 2020, respectively, the German government published its national Raw Materials Strategy. At the EU level, the European Commission has promoted ambitious regulatory initiatives such as the Critical Raw Materials Act and EU Battery Regulation, which focus on expanding the European mining capacities, diversifying imports, and reducing the overall demand for raw materials through recycling or product innovation. In addition, various EU member-state governments have applied the instrument of the so-called Important Projects of Common European Interest (IPCEI) to stimulate their domestic production of battery cells.

Yet while both EU institutions and national governments have already taken steps to reduce Europe’s strategic dependencies on China and other countries, within the battery and raw materials value chain, many challenges remain. Given the strategic importance of battery technologies for the German economy, the government’s upcoming National Security Strategy should recognize the existing risks – and provide geopolitically relevant concepts for the governance of the domestic and cross-border supply networks in the sector. At the same time, German policymakers need to acknowledge that country-level initiatives will have to be embedded into the broader context of EU regulations, trade relations, and conflicting economic interests.

More Coordination Between Industry and Governments

The first key challenge in building more resilient value chains in the EU battery sector is to organize government support for domestic technology and mining companies. For that, it is essential to acknowledge that EU companies are not operating on a level playing field but face unequal international competition. State-capitalist economies like China generally provide more direct economic support to their strategically important businesses than EU governments – and they can more effectively mobilize the firms’ business activities to exercise control over emerging transnational value-chain structures. Policymakers in the EU thus need to consider whether the bloc’s regulatory framework offers appropriate policy instruments for facilitating strategic industry-government coordination.

It has already been suggested that, in addition to the existing IPCEI framework, new and more generous funding instruments may be needed in order to more effectively promote industrial upgrading processes across member-state economies. In addition, considering the specific geopolitical vulnerabilities that characterize the battery supply chain, EU members need to collectively reflect on how the available funds will be used. Instead of simply replacing private with public investment, state-sponsored economic programs should be used to explore and indicate specific geo-strategic directions in which the European battery sector may develop. For instance, in order to reduce their current international dependencies, EU member states should prioritize high-risk investments in the development of battery designs that rely less on scarce natural resources like cobalt, nickel or lithium.

» Drawing on various kinds of state support, Chinese and Russian firms have already extended their direct investments and corporate control efforts into the raw-material sectors of the Global South. «

Furthermore, steps to develop secure transnational value-chain arrangements in the raw materials sector will require more substantial trade and foreign policy support by European government actors. A major reason for this is precisely the unequal competition with mining companies from authoritarian regimes. Drawing on various kinds of state support, Chinese and Russian firms have already extended their direct investments and corporate control efforts into the raw-material sectors of the Global South. EU governments must therefore step in and support the international investment and sourcing strategies of the European private sector by establishing bilateral partnerships and governance arrangements. Concrete trade and investment proposals must be put on the negotiating table – and access to the European internal market will certainly be a key bargaining chip in the process.

Common Standards and Strategy

In addition, from the German perspective, technological and other industrial standards can become a particularly important element of transnational governance dynamics in the battery and raw materials sectors. Common standards for products, components and production processes along the value chain would create a more level playing field and equalize competition between domestic and foreign firms. Such standards have yet to be established in the battery sector – and Germany has various important organizational and institutional resources at its disposal to drive the process. The German government can seek to support the ongoing industry-driven standardization efforts by increasing its collaboration with relevant domestic and international standardization bodies.

Finally, a significant obstacle that the EU will have to confront and surpass on its path toward greater independence and resilience in the low-carbon era is its own internal political dynamics. Conflicting economic interests of individual member states may well undermine a common approach to trade policies, international partnerships, and single-market regulation. It is worth recalling here that a key vulnerability driving the 2022 energy crisis was the weak coordination of member states’ national approaches to energy security. In particular, limited progress on the Energy Union initiative from 2014 left the bloc susceptible to Putin’s informal energy sanctions. Against this background, EU member states should make it a top priority to develop a common strategy for controlling the emerging supply networks for batteries and related raw materials.

» A key vulnerability driving the 2022 energy crisis was the weak coordination of EU member states’ national approaches to energy security. «

It is especially concerning, then, that the first fault lines are already becoming visible within the ongoing policymaking processes at the EU level. For example, the development and adoption of new sustainability standards for the internal battery market have reportedly been slowed down by opposition from some member states who are most keen to attract investment from Chinese manufacturers. In view of this, the EU needs to urgently reflect on how to meaningfully integrate a large group of interested national economies into both the proposed regulatory frameworks at the EU level and the domestically driven value chains that will emerge as a result of efforts to reduce international dependencies. One strategy for achieving this goal: member-state governments and EU institutions could set up new and more ambitious joint European industrial projects in the battery sector. And participation in such projects need not be limited to firms, innovators and governments from a few highly developed EU countries – in fact, it should especially involve the emerging Eastern and Southern European economies.

The announced National Security Strategy provides an opportunity for the German government to address these risks and, thereby, to enhance the country’s – and the EU’s – position within the emerging supply chains of the low-carbon economy. Berlin should not let it go to waste.

Grzegorz Lechowski

Research Fellow, WZB Berlin Social Science Center, Research Group 'Globalization, Work and Production'

Simon Wanka

Guest Researcher, WZB Berlin Social Science Center, Research Group 'Globalization, Work and Production'

Weiterlesen

Reality Check on China: Protecting Europe’s Science and Technology Potential

Many European states believe that they are no match for China. But as the French example reveals, this perception may be false. It is high time for Europe to take a realistic look at its dependencies and assets vis-à-vis China – especially in the field of science and technology.

Ohne Halbleiter-Strategie keine nachhaltige nationale Sicherheit

In der deutschen Ministerien und der Verwaltung mangelt es an technischem Sachverstand. Der wird allerdings dringend benötigt, um in den globalen Technologie-Ökosystemen strategisch zu handeln.